What seniors, people with disabilities, and undocumented adults need to know—and do now—to protect health coverage in 2026.

California’s Medi-Cal program—one of the largest public health insurance systems in the nation—is undergoing significant changes in 2026 that will affect millions of residents. For Latino families, seniors, people with disabilities, and mixed-status households, the updates carry real consequences for access to care, financial planning, and household stability.

State and county agencies, including the California Department of Health Care Services (DHCS), L.A. Care Health Plan, the County of Orange Social Services Agency, and the Health Consumer Alliance, are urging beneficiaries to prepare early to avoid losing coverage.

Asset limits return for seniors and people with disabilities

Starting January 1, 2026, Medi-Cal will once again apply asset limits for certain groups, reversing a policy change made during the pandemic years. Seniors aged 65 and older, people with disabilities, and some higher-income households will need to meet strict resource thresholds to remain eligible.

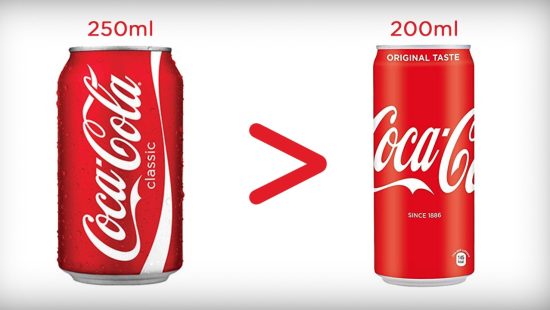

The new limits are set at $130,000 for an individual, with an additional $65,000 allowed for each extra household member, up to 10 people. Assets that may be counted include bank accounts, secondary properties, and some vehicles.

Consumer advocates note that this change will disproportionately affect older adults who saved modestly over a lifetime but still rely on Medi-Cal for long-term care, in-home support, or disability-related services. Failing to disclose assets accurately during renewal could lead to delays, denials, or termination of coverage.

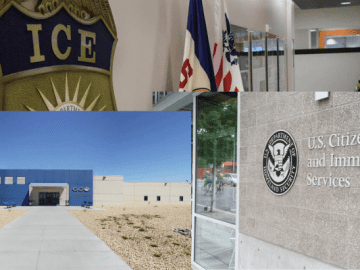

Enrollment freeze for undocumented adults

Also beginning January 1, 2026, California will freeze new applications for full-scope Medi-Cal for undocumented adults ages 19 and older. This does not remove coverage for people already enrolled, but it raises the stakes for timely renewals.

Health policy experts emphasize that undocumented adults who miss renewal deadlines—or fail to update required information—may lose coverage and be unable to reapply under the freeze. Children remain unaffected, and emergency and limited-scope services will continue as required by law.

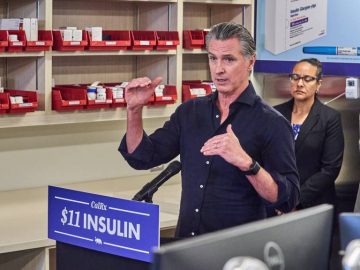

Dental coverage cutbacks in mid-2026

A second wave of changes arrives July 1, 2026, when full dental benefits will be reduced for undocumented adults. Routine services such as cleanings and fillings will no longer be covered, though emergency dental care—treatment for pain, infections, and extractions—will remain available.

Public health advocates warn that limiting preventive dental care often leads to higher emergency costs and worse long-term health outcomes, especially for workers in physically demanding jobs who already face barriers to care.

What beneficiaries should do now

Agencies and advocates agree that preparation is critical:

-

Report assets carefully during your next Medi-Cal renewal, including bank statements, property, and vehicles.

-

Confirm your immigration status information is current in the Medi-Cal system if it applies to you.

-

Plan ahead financially if you are near the asset limits. Experts caution that transferring assets without guidance can trigger penalty periods and jeopardize eligibility.

Why this matters

Medi-Cal is more than insurance—it is a safety net that supports family stability, workforce health, and community well-being. For Latino communities, where multigenerational households and caregiving responsibilities are common, even small administrative changes can ripple across entire families.

Advocacy organizations recommend seeking free, trusted assistance from legal aid groups or health consumer counselors before renewal deadlines. In a shifting policy landscape, staying informed may be the most important step toward protecting access to care in 2026 and beyond.

Medical Tourism in Tijuana: Why Rising Insurance Costs Are Pushing Angelinos to Look South